Investment Overview

The UNC Foundation manages the endowments it holds as separate accounts while it invests funds as part of its pooled investment portfolio. Accordingly, investment related activity is allocated to each fund on a quarterly basis and distributions to support the University according to donor directives, become available at the beginning of each fiscal year.

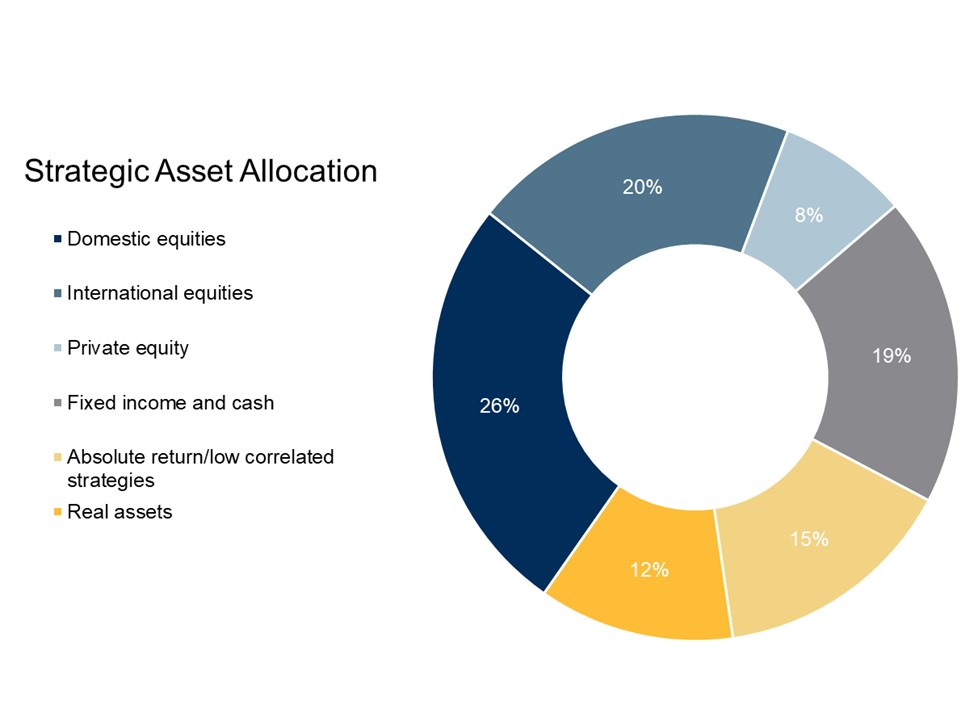

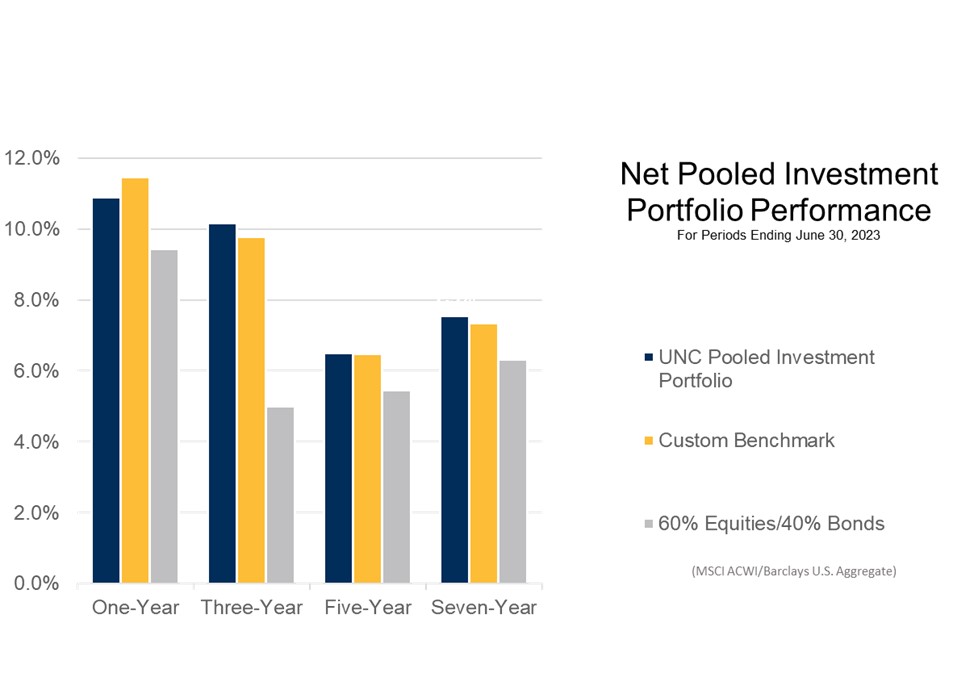

With investment objectives of achieving long-term earnings that provide support to the University while continuing to produce endowment growth, the UNC Foundation maintains a diversified asset allocation that considers inherent risks within the financial markets. Quarterly, the Foundation’s Investment Committee analyzes investment results in detail utilizing relevant benchmarks and comparisons to similar portfolios to evaluate performance.

The Foundation takes a long-term approach to investment management, however annual returns will vary from year to year. During the year ending June 30, 2023, while interest rates continued to rise, equities appreciated from the declines of the previous year. The UNC Foundation Pooled Investment Portfolio returned a gain of 10.9% (net of fees) for the year compared to its policy benchmark return of 11.5%, a slight short-term difference. Our longer-term results show consistent investment growth in line with our objectives of increasing support and effectively managing risks.

The Foundation’s Board of Directors and Investment Committee set guidelines for overall investment management as reflected in our Investment Policy which is reviewed and updated regularly. Our investment consultants leverage their resources and expertise to ensure investments are effectively managed for long-term results in compliance with the investment policy statement. Diversification is utilized across asset classes and investment managers in accordance with the requirements of the Uniform Prudent Investment of Institutional Funds Act (UPMIFA) and consistent with best practices which consider risk while focusing on long-term investment returns.